The hum of a struggling prototype, a factory floor suddenly silent, or perhaps just the cold, hard numbers flashing on a quarterly report—these are the subtle, sometimes heartbreaking, signs that herald the end for some ambitious players in the electric vehicle revolution. It’s a brisk autumn afternoon, a chill wind rustling through the leaves, mirroring the economic anxieties sweeping through the automotive sector. Just a few years ago, the mantra was ‘electrify everything!’ and new EV startups sprouted like mushrooms after a spring rain, each promising to redefine transportation. Venture capitalists threw billions at them, and consumers, eager for a greener future, lined up with deposits. But if you’re looking closely at the current landscape, especially at some of the lesser-known brands or those struggling to find their footing, you’ll start to see cracks in the polished veneer. Believe me, some of these electric vehicles won’t make it to 2026, and their companies along with them. It’s not a question of if, but which ones will falter in this brutally competitive race.

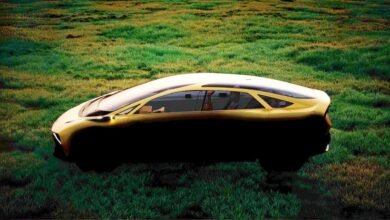

We’re standing on the precipice of a significant market correction, a true shakeout that will leave only the strongest, most adaptable, and financially robust companies standing. The initial euphoria has given way to a stark reality check. Remember the buzz, the excitement, the seemingly endless possibilities? It felt like every week brought a new contender to the stage, unveiling sleek designs and outlandish promises of range and performance. But the automotive industry is a graveyard of good intentions and underfunded dreams, and the EV segment is proving to be no different. The honeymoon phase is definitely over, and the market forces at play are relentless.

The truth is, many of these fledgling EV companies, some with intriguing concepts but weak execution, are facing an uphill battle against established giants with deep pockets, proven manufacturing capabilities, and extensive dealer networks. They’re battling not just for market share, but for survival itself. From soaring battery costs to intricate supply chain disruptions, and from consumer skepticism about charging infrastructure to the relentless pace of technological advancement, the hurdles are immense. It’s a perfect storm brewing, and for several contenders, the horizon of 2026 looks less like a finish line and more like a cliff edge. It’s a sobering thought, but one we must confront as we watch this fascinating, yet brutal, transition unfold.

The Harsh Realities of a Crowded Market

It wasn’t that long ago that the EV market felt like the Wild West—a vast, open frontier where anyone with an innovative idea and a charismatic CEO could stake a claim. Everyone wanted a piece of the pie. Automakers, from century-old titans to ambitious startups, announced colossal investments in electric vehicles, painting a picture of a future dominated by silent, emission-free motoring. And for a while, it worked. Valuations soared, pre-orders piled up, and the narrative was overwhelmingly positive. “It felt like a gold rush,” recalled Sarah Chen, a senior analyst at AutoInsights Group, during a recent online conference. “Every investor wanted in, every engineer wanted to be part of the next big thing. But what happens in a gold rush? Most prospectors find nothing, and only a few strike it rich.”

Now, the market is maturing, and the initial flood of enthusiasm is being tempered by the hard realities of manufacturing, sales, and profit margins. We’re witnessing a natural, albeit painful, process of market consolidation. There are simply too many players vying for the same slice of the pie. Think about it: a few years ago, we had dozens of brands promising revolutionary electric trucks, luxury sedans, and affordable compacts. Many of these concepts were brilliant on paper, stunning in CGI renders, but translating that into mass-produced, profitable vehicles is an entirely different beast. The competition isn’t just fierce; it’s existential. Legacy automakers like Ford, GM, Hyundai, and Volkswagen have pivoted aggressively, pouring billions into their own EV platforms, leveraging decades of manufacturing expertise, established supply chains, and vast dealer networks. This makes it incredibly difficult for a new entrant to compete on scale, cost, or even brand recognition.

The Funding Crunch and Investor Skepticism

Perhaps the most immediate threat to many smaller EV startups is the tightening grip of capital. For years, venture capitalists and institutional investors poured money into promising EV ventures, often valuing potential over actual profits. But the economic climate has shifted dramatically. Rising interest rates mean borrowing money is more expensive, and investors are demanding a clearer path to profitability, not just impressive prototypes. The era of “growth at all costs” without a concrete revenue stream is rapidly fading.

I remember chatting with a friend, Mark, who works in venture capital, last spring. We were grabbing coffee, and he looked utterly exhausted. “The phone just stopped ringing with the big checks, you know?” he confided, stirring his espresso. “Everyone’s suddenly asking about EBITDA, not just projected market share. It’s brutal out there. Companies that were just weeks from closing a big round are now scrambling, having to slash valuations or worse, just fold.” This sentiment is echoed across the industry. Many of these startups burned through cash at an alarming rate, often without achieving significant production milestones or securing substantial customer orders. Their business models often relied on continuous infusions of capital to bridge the gap between concept and reality. When that funding dries up, operations grind to a halt. We’ve already seen several high-profile examples of companies struggling to raise their next funding rounds, laying off staff, or outright declaring bankruptcy. This trend is only accelerating, and it’s a major reason why some EV brands won’t make it to 2026.

Production Pains and Supply Chain Nightmares

Building a car, especially a complex electric vehicle, is incredibly hard. It requires massive capital investment in factories, sophisticated robotics, and an intricately managed global supply chain. This isn’t just about bolting parts together; it’s about integrating thousands of components, from microchips to battery cells, each with its own sourcing challenges. Many EV startups underestimated this complexity. They excelled at design and innovation but stumbled when it came to scaling production.

Think about the persistent chip shortages that plagued the entire automotive industry for years, or the volatile prices of critical raw materials like lithium, nickel, and cobalt. These aren’t minor inconveniences; they are fundamental roadblocks. “We had the perfect design, truly,” said a former production manager for a now-defunct EV truck company, who wished to remain anonymous to avoid professional repercussions. His voice was laced with a mix of pride and regret. “But getting enough battery cells? Impossible. Or we’d get them, but the price would jump 30% overnight. How do you plan for that? We were constantly chasing parts, constantly redesigning on the fly just to keep the line moving, barely. It was a nightmare.” These production pains, coupled with stringent quality control requirements and the looming threat of recalls (which can be financially devastating), are crushing many smaller players before they even reach significant volume.

Consumer Demand: Not a Silver Bullet for All

While overall EV adoption is undoubtedly on the rise, it’s not a uniform wave lifting all boats. Consumers are becoming more discerning. The early adopters, willing to overlook imperfections for the sake of novelty and environmental benefits, have mostly made their purchases. The next wave of buyers is more pragmatic. They’re looking for reliability, competitive pricing, extensive charging infrastructure, and proven after-sales support. This is where many newer, smaller EV companies struggle.

Range anxiety is still a very real concern for many, and while the charging network is expanding, it’s not always reliable or ubiquitous, especially for proprietary connectors or less common brands. I remember being stuck at a charging station in a small town last summer, waiting for nearly an hour for an available charger, watching cars from major manufacturers zip in and out. It made me wonder how a driver of a niche EV brand would feel in that situation, potentially unable to find a compatible or available charger. Legacy automakers, with their vast service networks and established charging partnerships, inherently have an advantage here. Furthermore, the price wars are heating up. As larger players ramp up production and seek economies of scale, they can offer more competitive pricing. This puts immense pressure on smaller companies that often have higher per-unit costs due to lower production volumes and less negotiating power with suppliers. For a brand to genuinely thrive, it needs more than just a cool design; it needs to deliver on a holistic ownership experience that matches or exceeds its internal combustion engine counterparts, and importantly, its electric rivals.

Identifying the Vulnerable Players

So, who exactly is at risk? While naming specific companies can be speculative, we can certainly identify the characteristics of those teetering on the edge. These aren’t necessarily “bad” companies or products, but rather ones facing an insurmountable combination of market, financial, and operational challenges.

Here are some warning signs that an EV manufacturer might not survive the intense competition leading up to 2026:

- Single-Model Dependency: Companies that have put all their eggs in one basket with a single, unproven model, especially if it’s in a highly competitive segment like luxury SUVs or pick-up trucks. If that one model doesn’t sell well or faces significant production delays, their entire future is jeopardized.

- Exorbitant Pricing for Minimal Differentiation: Brands attempting to charge premium prices without offering truly unique technology, superior range, or a compelling user experience that justifies the cost. Consumers are increasingly price-sensitive, and mere “electric” status isn’t enough anymore.

- Lack of Proprietary Charging Solutions or Robust Partnerships: While the industry is moving towards standardization, companies with poor charging network integration or without strong alliances for charging infrastructure will struggle to reassure prospective buyers.

- Outdated Battery Technology or Insufficient Range: In a rapidly evolving field, companies still relying on less efficient or slower-charging battery chemistries, or those offering significantly lower range than competitors at a similar price point, will quickly become obsolete.

- Persistent Production Woes and Quality Control Issues: Continuous delays, missed production targets, major recalls, or widespread reports of quality issues erode consumer trust and drain financial resources.

- High Burn Rate and Struggling to Secure Funding: This is arguably the biggest indicator. If a company is constantly announcing new fundraising rounds but failing to meet production goals, or worse, announcing layoffs and restructuring, it’s often a sign of deep financial distress.

- Limited Geographical Reach: Companies focused only on a small regional market without a clear strategy for broader expansion will find it hard to achieve the economies of scale needed for long-term survival.

It’s a tough environment, and for brands exhibiting several of these characteristics, the path to 2026 looks increasingly narrow, even treacherous.

The Resilient Ones: What It Takes to Survive

It’s not all doom and gloom, of course. For every company that falters, there will be others that adapt, innovate, and thrive. So, what sets the resilient players apart? It comes down to a combination of strategic foresight, financial strength, and an unwavering focus on execution. Companies with strong balance sheets, access to diverse funding sources, and a clear, pragmatic product roadmap are much better positioned. These aren’t just companies that make good cars; they are companies that have mastered the entire ecosystem of automotive manufacturing and sales.

They are investing heavily in advanced battery technology, pushing the boundaries of energy density and charging speeds. They are building robust, resilient supply chains, often through vertical integration or strategic long-term contracts for critical materials. Furthermore, the survivors are those who understand the importance of charging infrastructure and are actively working on solutions, whether through proprietary networks, partnerships, or advocating for industry standards. They’re also excelling at software integration, recognizing that the “connected car” experience is just as vital as horsepower and range. Government support, in the form of subsidies or regulatory incentives, also plays a crucial role, often providing a lifeline or a competitive edge. Ultimately, the companies that make it to 2026 and beyond will be those that offer compelling products at competitive prices, backed by reliable manufacturing, strong service, and a clear vision for the future of personal mobility.

Conclusion

The road ahead for the electric vehicle market is undoubtedly exhilarating, but it’s also fraught with challenges. The notion that “these EVs won’t make it to 2026” isn’t a pessimistic outlook; it’s a realistic assessment of a rapidly maturing industry undergoing intense consolidation. We’ve seen the initial exuberance give way to a more sober, competitive landscape where only the most adaptable, innovative, and financially robust companies will endure.

It’s a natural evolution, really. Every major technological shift sees a wave of innovation, followed by a period of shakeout where the strong survive and the weak perish. For consumers, this consolidation might mean fewer choices in the short term, but ultimately, it should lead to higher quality, more reliable, and better-supported electric vehicles from the companies that truly prove their worth. So, as we approach 2026, keep an eye on the headlines. The EV market is about to get a lot leaner, and while it might be tough for some, it will undoubtedly forge a stronger, more sustainable future for electric mobility. It’s a wild ride, isn’t it?

Frequently Asked Questions

| Why are some EVs predicted not to make it to 2026? | Many electric vehicle (EV) companies, especially newer startups, are facing significant challenges including intense market competition, a tightening funding environment, complex production hurdles, supply chain disruptions, and evolving consumer demands. These factors combine to create a highly challenging landscape where not all players can survive. |

| What are the key factors contributing to the potential failure of some EV brands? | Key factors include fierce competition from established legacy automakers, difficulty in securing continuous venture capital funding, the high cost and complexity of scaling manufacturing, volatility in raw material prices (like lithium), and the ongoing development of charging infrastructure and consumer acceptance beyond early adopters. |

| Which types of EV companies are most at risk? | Companies most at risk typically exhibit characteristics such as dependency on a single model, exorbitant pricing without significant differentiation, a lack of robust charging solutions, outdated battery technology, persistent production or quality control issues, a high cash burn rate without clear profitability, and limited geographical reach. |

| How does consumer demand affect the survival of EV companies? | While overall EV adoption is growing, consumer demand is becoming more discerning. Buyers now prioritize reliability, competitive pricing, extensive charging infrastructure, and proven after-sales support. Smaller companies often struggle to meet these demands compared to larger, established automakers, impacting their sales volumes and long-term viability. |

| What qualities will help EV companies survive and thrive beyond 2026? | Survivors will typically possess strong financial backing, pragmatic product roadmaps, advanced battery technology, resilient supply chains, robust charging solutions, excellent software integration, and a clear vision for the future. Strategic partnerships and adaptability to market changes will also be crucial for long-term success. |

Important Notice

This FAQ section addresses the most common inquiries regarding the topic.