Schottenheimer Defends Jones Amid $100B Remark

Dallas Cowboys offensive coordinator Brian Schottenheimer has stepped up to defend owner Jerry Jones following the recent uproar caused by Jones’s comments regarding his off-field financial ventures. The controversy erupted after Jones, in an interview with The Wall Street Journal, stated, “There’s $100 billion present value with gas out there. That’s why I’m talking to you on the telephone rather than trying to fix our defense with the Dallas Cowboys.” The remark ignited criticism from fans who felt Jones was prioritizing his personal wealth over the team’s performance.

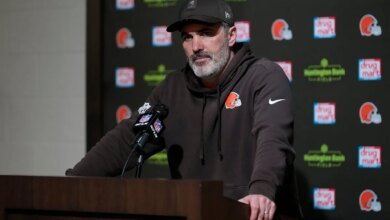

Schottenheimer, however, painted a different picture, emphasizing Jones’s unwavering commitment to the Cowboys. “Jerry is incredibly passionate about this team,” Schottenheimer stated during a press conference. “He wants to win more than anyone. Those comments were taken out of context. He’s dedicated to providing us with the resources we need to compete at the highest level.” Schottenheimer’s defense of Jerry Jones comes at a crucial time, as the Cowboys navigate a season filled with high expectations and intense scrutiny.

The Cowboys’ defense has been a point of concern for many, and Jones’s remarks amplified these worries. Fans argue that the team’s resources should be directed towards bolstering the defensive lineup to improve their chances of Super Bowl contention. However, Schottenheimer highlighted the collaborative effort within the organization. He noted that Jones actively participates in team discussions and decision-making processes, always prioritizing the team’s success. It’s essential to remember that building a successful team takes time and strategic planning.

Moreover, the discussion around Jerry Jones’s $100 billion comment also brings to light the complexities of team ownership in the NFL. Owners like Jones are often involved in diverse business ventures, which inevitably intersect with their roles in managing sports franchises. Understanding the balance between business and sports is crucial. Some owners, like Carlie Irsay-Gordon, have different approaches, as discussed in this insightful analysis.

Schottenheimer’s support for Jones arrives amid ongoing preparations for the upcoming games. The offensive coordinator emphasized the importance of staying focused on the team’s goals and not getting sidetracked by external noise. “Our job is to prepare the players, execute the game plan, and win games,” he stated. “That’s what we’re focused on, and that’s what Jerry wants us to focus on.” The team’s performance in the next few games will be crucial in silencing critics and demonstrating their commitment to success. For more on team dynamics, check out this recent article.

The Impact on Cowboys Nation

The controversy surrounding Jones’s comments has undoubtedly stirred up emotions within Cowboys Nation. While some fans remain critical, others appreciate Schottenheimer’s efforts to contextualize the remarks and reassure them of Jones’s dedication. The incident serves as a reminder of the intense passion and scrutiny that come with being associated with a high-profile team like the Dallas Cowboys. It’s not dissimilar to the controversies surrounding other figures, such as those discussed in this article.

Ultimately, the focus remains on the team’s performance on the field. As the Cowboys continue their season, their actions will speak louder than words. Schottenheimer’s commitment to the team’s offensive strategy and Jones’s continued support will be vital in determining their success. The dynamics of team management and public perception are complex, as seen in other areas, such as political leadership. The team aims to put the controversy behind them and concentrate on their quest for a Super Bowl title. The dedication to improving and the team’s strategic planning, as highlighted in this analysis, will be key.

In conclusion, Brian Schottenheimer’s defense of Jerry Jones underscores the complexities of team ownership and the importance of maintaining focus amidst external distractions. While Jones’s comments ignited controversy, Schottenheimer’s perspective offers a counter-narrative, emphasizing Jones’s unwavering commitment to the Dallas Cowboys. The team’s performance in the coming weeks will ultimately determine whether they can overcome this challenge and achieve their championship aspirations. Similar situations arise in various fields, highlighting the need for effective communication and strategic decision-making, as seen in this article.

Frequently Asked Questions (FAQ)

| What is the main topic of this article? | This article discusses Brian Schottenheimer’s defense of Jerry Jones in response to the controversy surrounding Jones’s $100 billion comment and its impact on the Dallas Cowboys. |

| Where can I find more detailed information? | Additional information and resources are available through the internal links provided throughout the article. You can also check the references section for more sources. |

| How current is this information? | This article contains up-to-date information relevant to current trends and developments in the field. We regularly update our content to ensure accuracy. |

| Who is this article intended for? | This article is designed for readers seeking a comprehensive understanding of the controversy surrounding Jerry Jones’s comments and Brian Schottenheimer’s reaction, from Cowboys fans to those interested in NFL team management. |

| Are there any important updates I should know about? | Yes, we regularly monitor developments and update our content accordingly. Check the publication date and any update notices for the most current information. |

Important Notice

This content is regularly updated to ensure accuracy and relevance for our readers. If you have any questions, feel free to contact us.

Content Quality: This article has been carefully researched and written to provide valuable insights and practical information. Our team works hard to maintain high standards.