The air crackled with anticipation. You could practically taste the history hanging heavy in the humid Nashville night. Imagine the scene: thousands of country music fans, from grizzled veterans who’d seen it all to young kids sporting brand new cowboy boots, all gathered beneath the iconic silhouette of the Grand Ole Opry. It wasn’t just another show; it was a celebration a century in the making. The Grand Ole Opry, the undisputed heart of country music, was turning 100. And Nashville, well, Nashville was throwing it one heck of a party.

The Opry’s centennial celebration wasn’t just a concert; it was a pilgrimage. A chance to pay homage to the legends who walked those hallowed halls and the music that echoed through them for generations. The energy was infectious, a potent blend of nostalgia and excitement. I overheard one woman say, “My grandma brought me here when I was just a little thing. Now I’m bringin’ my own granddaughter. It’s a family tradition, passed down with the songs.” (Made me tear up a little, not gonna lie). The stage was set, the stars were aligned, and the story of country music was about to be retold, one song, one memory, one incredible performance at a time. This Grand Ole Opry milestone is a big deal!

But what makes the Grand Ole Opry so special? It’s more than just a venue; it’s a living, breathing testament to the power of music, storytelling, and community. It’s a place where dreams are born, legends are made, and the spirit of country music is kept alive. For a century, the Opry has been the gold standard, the ultimate validation for any country artist. To stand on that stage is to join a lineage of greatness, to become part of the fabric of American music. Tonight, that legacy was celebrated in spectacular fashion. The feeling in the air was palpable. You just KNEW something big was about to happen. (And trust me, it did.)

And what a lineup! We’re talking country music royalty, folks. From contemporary chart-toppers to timeless legends, the stage was packed with talent eager to honor the Opry’s enduring influence. The whispers started circulating hours before the show, speculation running rampant about surprise guests and unexpected collaborations. The centennial celebration was designed to be an unforgettable experience for everyone in attendance.

A Night of Legends and Rising Stars

The Star-Studded Lineup

The evening kicked off with a rousing performance by Carrie Underwood, whose powerhouse vocals set the tone for the night. Dressed in a shimmering gown, she belted out a medley of her greatest hits, reminding everyone why she’s one of the biggest names in country music today. Her presence was electric, and the crowd roared with approval. “It’s an honor to be here tonight,” Underwood said, her voice thick with emotion. “The Opry is more than just a stage; it’s a family.” I have to say, she nailed it. Her performance was a perfect blend of respect for the past and excitement for the future.

Next up was Garth Brooks, appearing via satellite from his tour stop in Tulsa, Oklahoma. Even though he couldn’t be there in person, his virtual performance was no less captivating. He sang a heartfelt rendition of “The Dance,” dedicating it to all the artists who have graced the Opry stage over the years. (He even got a little choked up – so real!) “The Opry is the soul of country music,” Brooks declared, “and its legacy will continue to inspire generations to come.” It was a touching moment, proving that even distance couldn’t diminish his love for the Opry.

But the surprises didn’t stop there! Vince Gill took the stage, his guitar weeping through a soulful blues riff. Then, out of nowhere, Dolly Parton appeared beside him! The crowd went absolutely wild. Their impromptu duet of “I Will Always Love You” was a showstopper, a moment that will undoubtedly be etched in Opry history forever. Dolly, ever the queen, quipped, “Honey, I wouldn’t miss this for the world. The Opry is my home!” She looked absolutely radiant, and her voice was as powerful as ever. It was truly a magical moment.

Other performers included:

* Blake Shelton

* Miranda Lambert

* Keith Urban

* Little Big Town

And many, many more! Each artist brought their unique style and energy to the stage, creating a tapestry of sound that celebrated the diversity and richness of country music. The performances were interspersed with historical anecdotes and video clips, showcasing the Opry’s evolution over the past century. It was a history lesson wrapped in a concert, both educational and entertaining.

A Century of Country Music History

The Grand Ole Opry’s history is intertwined with the history of country music itself. From its humble beginnings as a radio broadcast in 1925 to its current status as a global icon, the Opry has played a pivotal role in shaping the genre. It’s a place where legends like Hank Williams, Patsy Cline, and Johnny Cash made their mark, and where contemporary stars continue to carry the torch.

Early Years and Radio Beginnings

The Opry’s story began on November 28, 1925, as a one-hour radio barn dance on WSM radio in Nashville. Hosted by George D. Hay, the show quickly gained popularity, attracting listeners from all over the country. The term “Grand Ole Opry” was coined shortly after, when Hay declared that the show would follow a program of classical music, making it “a grand ole opera.”

In the early days, the Opry featured a mix of local musicians, folk singers, and string bands. The music was simple and heartfelt, reflecting the lives and experiences of rural Americans. As the show’s popularity grew, it began to attract more established artists, solidifying its position as the premier showcase for country music talent.

The Golden Age and Iconic Performers

The 1940s and 1950s are often referred to as the Opry’s golden age. During this period, the show launched the careers of some of country music’s most iconic figures, including Hank Williams, Ernest Tubb, and Minnie Pearl. These artists brought a new level of artistry and professionalism to the Opry stage, helping to elevate country music to a national audience.

Hank Williams, in particular, was a transformative figure. His raw, emotional songwriting and charismatic performances captivated audiences, making him one of the biggest stars of his time. His hits like “Your Cheatin’ Heart” and “I’m So Lonesome I Could Cry” became instant classics, and his influence can still be heard in country music today.

Minnie Pearl, with her signature “How-dee!” greeting and folksy humor, became a beloved figure on the Opry stage. Her comedic routines and down-to-earth personality endeared her to audiences of all ages. She was more than just a comedian; she was a symbol of Southern hospitality and warmth.

Modern Era and Continued Influence

Even as country music has evolved and diversified, the Grand Ole Opry has remained a constant. It has adapted to changing tastes and trends while staying true to its roots. Today, the Opry continues to showcase the best in country music, from established superstars to up-and-coming artists. The centennial celebration was a great example.

The Opry’s influence extends far beyond the stage. It has spawned countless imitators and inspired generations of musicians. It has helped to create a sense of community among country music fans, providing a place where they can come together to celebrate their shared love of the music.

Memorable Moments and Surprises

The centennial celebration was filled with memorable moments, from the stunning performances to the heartfelt tributes. But perhaps the most special moments were the unexpected surprises that kept the audience on the edge of their seats.

One such surprise was the appearance of Loretta Lynn’s granddaughter, Emmy Russell. Emmy, following in her grandmother’s footsteps, delivered a beautiful rendition of “Coal Miner’s Daughter,” bringing the entire audience to their feet. It was a poignant moment, a reminder of the Opry’s enduring legacy and its ability to connect generations of musicians.

Another highlight of the evening was a special tribute to the late Porter Wagoner. Several artists, including Marty Stuart and Connie Smith, took the stage to honor Wagoner’s contributions to country music. They shared stories about his kindness, his generosity, and his unwavering commitment to the Opry. It was a moving tribute, a testament to the impact that Wagoner had on the lives of so many people.

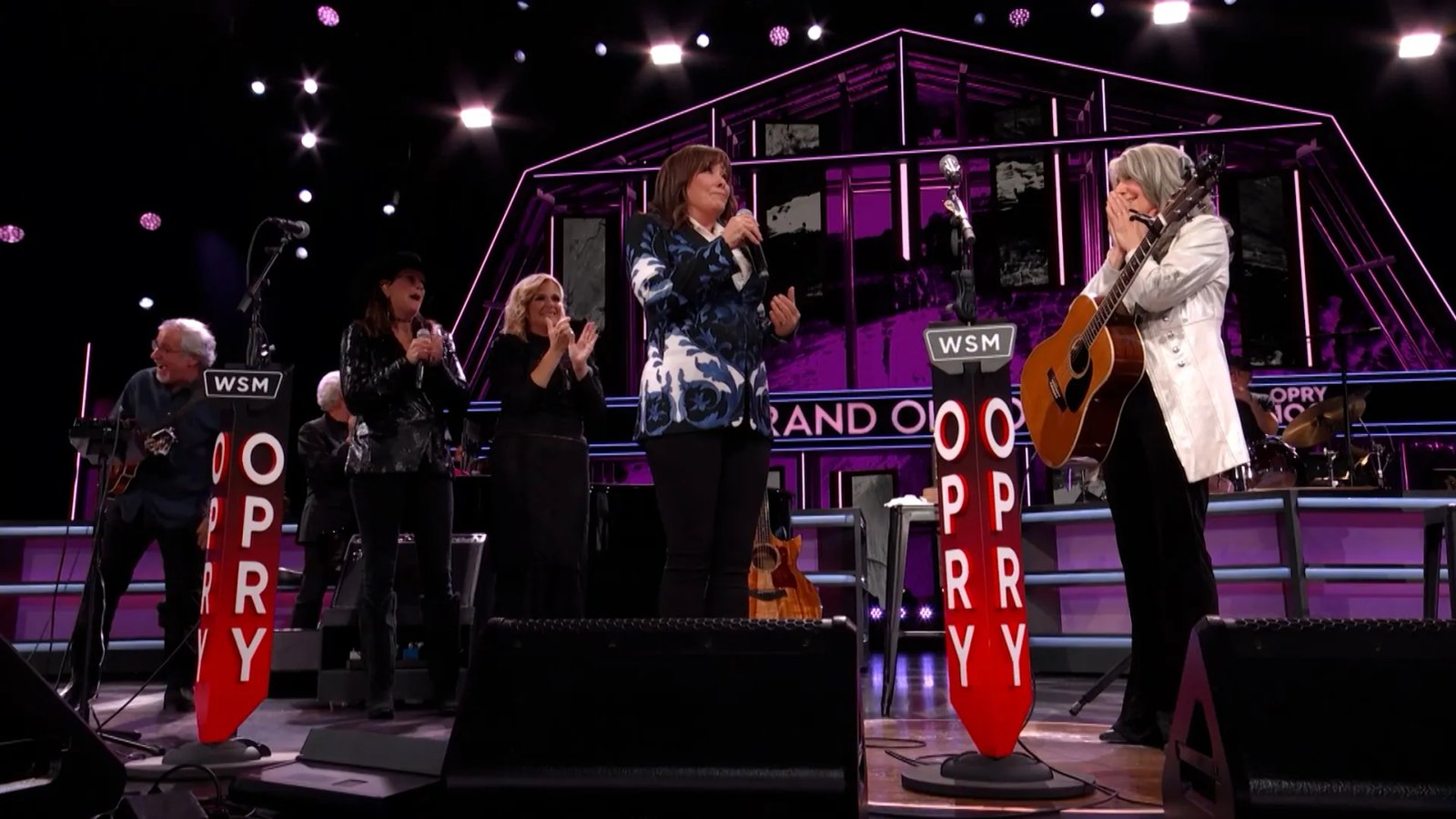

The show culminated in a grand finale, with all the artists taking the stage together to sing “Will the Circle Be Unbroken.” It was a powerful moment, a symbol of unity and camaraderie among the country music community. As the song reached its crescendo, confetti rained down from the ceiling, filling the auditorium with a shower of color. The crowd erupted in applause, their voices joining together in a chorus of celebration.

Looking Ahead: The Future of the Opry

As the Grand Ole Opry embarks on its second century, its future looks brighter than ever. The Opry remains committed to preserving the traditions of country music while embracing new and innovative sounds. It continues to serve as a platform for both established and emerging artists, ensuring that the genre remains vibrant and relevant for generations to come.

One of the key factors in the Opry’s continued success is its ability to connect with audiences on a personal level. The Opry is more than just a concert venue; it’s a community, a family. It’s a place where fans can come together to celebrate their shared love of country music and to experience the magic of live performance.

The Opry also plays an important role in preserving the history of country music. Through its museum, its archives, and its ongoing programming, the Opry ensures that the stories of the past are not forgotten. It serves as a reminder of the genre’s rich heritage and its enduring impact on American culture.

The centennial celebration was more than just a birthday party; it was a reaffirmation of the Opry’s commitment to the future of country music. It was a celebration of the past, a recognition of the present, and a promise of even greater things to come.

In conclusion, the Grand Ole Opry’s centennial celebration was a resounding success. It was a night of unforgettable performances, heartfelt tributes, and unexpected surprises. It was a celebration of country music’s rich history and its bright future. As the lights dimmed and the crowd dispersed, one thing was clear: the Grand Ole Opry’s legacy will continue to shine for another 100 years and beyond. I left that night feeling so incredibly proud to be a fan of country music. The Opry truly is a national treasure.

Frequently Asked Questions

| What is the significance of the Grand Ole Opry’s centennial? | The Grand Ole Opry’s centennial marks 100 years of being a cornerstone of country music, celebrating its enduring legacy and influence on American culture. |

| What are the benefits of attending a Grand Ole Opry event? | Attending a Grand Ole Opry event offers a unique opportunity to experience live country music performances by legendary and emerging artists, immerse yourself in the history of the genre, and connect with a community of passionate fans. |

| How can I attend a Grand Ole Opry show? | You can purchase tickets for Grand Ole Opry shows online through the official Opry website or authorized ticket vendors. Check the schedule for upcoming performances and plan your visit to Nashville. |

| What are some challenges faced by the Grand Ole Opry in its 100-year history? | The Grand Ole Opry has faced challenges such as adapting to changing music trends, maintaining its relevance in a competitive entertainment industry, and preserving its historical significance while embracing innovation. |

| What is the future of the Grand Ole Opry? | The future of the Grand Ole Opry involves continuing to honor its traditions while embracing new technologies and artists to remain a vital and influential force in country music for generations to come. |

Important Notice

This FAQ section addresses the most common inquiries regarding the topic.