The morning chill in Zuffenhausen, Stuttgart, felt sharper than usual as the news wires started buzzing. It was a Monday, typically a day of fresh starts and new ambitions, but for the automotive world, particularly the luxury segment, it brought a jolt of concern. The headlines were stark, unequivocal: Porsche’s operating profits have plummeted. For a brand synonymous with precision engineering, relentless innovation, and, crucially, robust financial health, this announcement sent a ripple of surprise through investors, enthusiasts, and competitors alike. I remember seeing the alert pop up on my screen, and my first thought was, “Porsche? Really?” This isn’t some struggling startup; this is a titan, a benchmark for profitability in the often-volatile automotive industry. This isn’t just a minor dip; it represents a significant challenge to the brand’s otherwise sterling financial performance, prompting immediate questions about the underlying health of the luxury car market and the broader automotive industry. We’re talking about a company that has consistently defied economic headwinds, delivering vehicles that command premium prices and even higher margins. So, what on earth could be happening behind the gleaming facades of their dealerships and the precision lines of their factories that would lead to such a drastic revenue decline and a genuine profitability crisis? It’s a complex tapestry of global economics, internal strategy, and external pressures, all converging to create a difficult moment for one of the world’s most iconic marques.

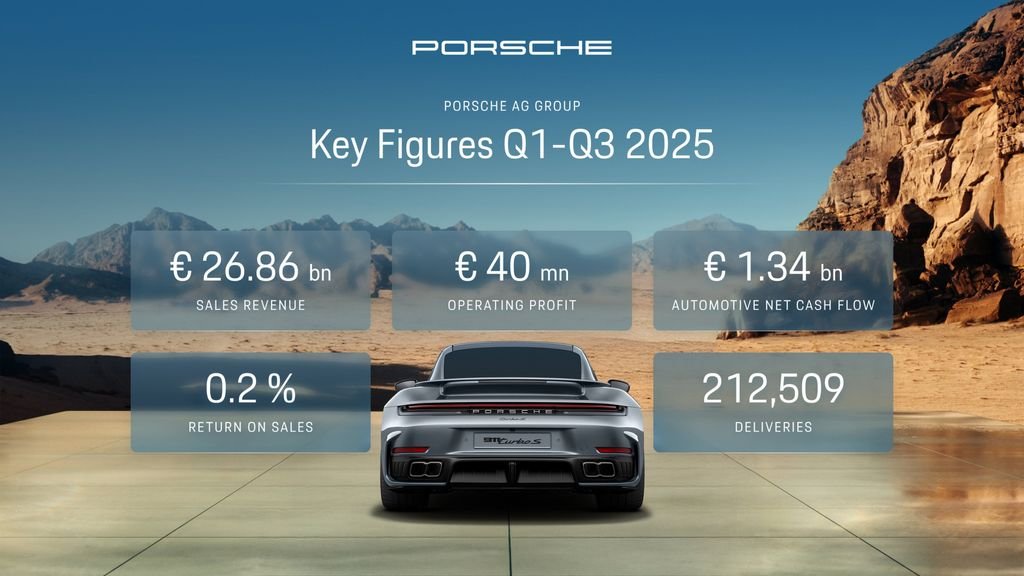

The Unsettling Numbers: A Deep Dive into Porsche’s Profit Plunge

Let’s cut right to the chase, shall we? The latest financial reports paint a picture that few would have anticipated. In the last fiscal quarter, Porsche’s operating profits have plummeted by a concerning 12% compared to the same period last year. While revenue saw a modest increase of about 3%—a testament to continued strong demand for their vehicles—the crucial metric of profit margin tells the real story. It has contracted significantly, indicating that the cost of doing business has escalated dramatically, or the profitability per unit has taken a hit. This isn’t just an accounting hiccup; it’s a profound shift for a company that has historically boasted double-digit operating margins, often the envy of its peers.

“This isn’t just a blip; it’s a significant shift. For a brand like Porsche, known for its robust margins and consistent outperformance, these numbers are a wake-up call, not just for them but for the entire premium automotive segment,” observed Marcus Klein, a senior automotive analyst at Global Auto Insights, during a morning investor call. His voice carried a tone of measured concern, echoing the sentiment across the financial markets. For years, Porsche has been a bastion of financial strength, a rare beast that combined passion, performance, and serious profitability. To see such a dip suggests that even the most well-oiled machines can be affected by the gears of a volatile global economy.

Navigating the Storm: Key Factors Behind the Downturn

So, what precisely has thrown a wrench into the finely tuned engine of Porsche’s financial performance? It seems to be a confluence of several powerful, interconnected forces, creating what many are calling the “perfect storm” for the luxury automaker.

Persistent Supply Chain Disruptions

Even as headlines have moved on from the peak of the global chip shortage, the reality on the ground for automakers is that supply chain challenges persist. While the situation isn’t as dire as it once was, bottlenecks still plague the industry, particularly for high-end components. Think about the complex electronics, the intricate infotainment systems, and the advanced driver-assistance features that define a modern Porsche—each requires a steady stream of specialized semiconductors and other high-tech parts.

“It’s like trying to bake a cake when you’re constantly running out of flour or eggs, but you can’t just substitute them,” a production manager at a supplier factory, who wished to remain anonymous, told me over a hurried phone call. “We get parts, but not always enough, or they arrive late. This means pausing lines, scrambling for alternatives, and ultimately, fewer cars rolling off the assembly line. Every delay costs money, and it limits the production of our most profitable models.” These production bottlenecks lead to lost sales opportunities for vehicles that carry the highest margins, directly impacting the bottom line. The ripple effect of component scarcity is far-reaching, turning efficient operations into a logistical headache.

Evolving Market Landscape and Economic Headwinds

Beyond the factory floor, the global economic climate is presenting its own set of trials. We’re living in an era of persistent inflation and rising interest rates, which, surprisingly, can affect even the most affluent buyers. While the super-rich might be immune, a significant portion of Porsche’s customer base consists of successful professionals and entrepreneurs who, while comfortable, are not entirely insulated from economic shifts.

“We’re seeing a slight hesitation, even among our most loyal customers,” a source close to Porsche’s sales department confided quietly, requesting anonymity to speak freely. “The overall economic uncertainty is palpable, and it affects even the decisions for a new 911 or a fully loaded Cayenne. It’s not that they can’t afford it, but perhaps they’re deferring big purchases or choosing slightly less optioned versions.” This observation highlights a subtle but significant shift in consumer confidence within the luxury market trends. Geopolitical tensions in various parts of the world also add to this instability, dampening demand in key export markets. These factors, combined, create a less favorable environment for discretionary luxury spending.

The High Cost of Electrification

Perhaps one of the most significant, yet often underestimated, factors impacting Porsche’s profitability crisis is the monumental investment required for the brand’s ambitious EV transition costs. Porsche, like virtually every major automaker, is pouring billions into developing electric vehicle platforms, battery technology, and charging infrastructure. The Taycan was just the beginning, with an electric Macan and 718 models on the horizon.

Developing entirely new electric architectures is incredibly expensive, involving massive research and development expenditures. Moreover, the initial electric vehicle profitability margins are often thinner than those of their traditional internal combustion engine (ICE) counterparts. This is due to the high cost of batteries, specialized manufacturing processes, and the need to scale production. It’s an essential strategic move for the future, but it’s a massive financial drain in the short to medium term. Think of it like building a brand-new superhighway – the upfront costs are astronomical, and while the long-term benefits are clear, the immediate impact on the balance sheet can be quite jarring. Porsche is essentially investing heavily in its future, but that investment comes with a hefty price tag that is currently squeezing its operating profits.

Porsche’s Counter-Strategy: Steering Towards Recovery

Faced with these formidable challenges, Porsche is certainly not sitting idle. The brand is known for its resilience and methodical approach, and internal discussions are reportedly intense, focusing on swift and effective counter-strategies.

“We are absolutely committed to our ambitious electrification strategy, but we are also rigorously reviewing every operational aspect to ensure we navigate these headwinds effectively,” stated Oliver Blume, CEO of Porsche AG, in a recent internal memo that was reportedly circulated among employees. This sentiment underscores a two-pronged approach: unwavering commitment to the future, coupled with immediate and decisive action on current financial performance.

One key area of focus is aggressive cost optimization. This involves scrutinizing every non-essential expenditure, finding efficiencies in production processes, and leveraging group synergies within the wider Volkswagen Group. Every component, every process, every supplier contract is likely under review to identify areas where costs can be trimmed without compromising the brand’s legendary quality or performance.

Secondly, there’s a renewed emphasis on prioritizing the production and delivery of their highest-margin models. In times of limited component availability, it makes financial sense to allocate scarce resources to vehicles like the 911 GT3 or highly customized Turbo S models, which generate the most significant profits per unit. This tactical shift is part of a broader strategic realignment to maximize immediate returns while the longer-term EV strategy matures. Furthermore, Porsche is likely working tirelessly to solidify its supply chains, perhaps diversifying suppliers or even investing in some upstream capabilities to mitigate future disruptions. They are also optimizing their EV rollout, aiming for greater economies of scale as they launch new electric models, hoping to improve electric vehicle profitability over time. The journey towards recovery will demand agility and foresight, transforming these challenges into opportunities for refining their operations and strengthening their core business.

Wider Implications and the Road Ahead for Luxury Automotive

The fact that Porsche’s operating profits have plummeted sends a clear signal across the entire automotive industry outlook. If a brand as strong and profitable as Porsche can be hit so hard, what does it mean for other luxury marques? We might see similar pressures on competitors, especially those also undergoing massive electrification programs. This isn’t just a Porsche problem; it’s a reflection of broader economic and structural shifts impacting premium segments globally.

In the short term, we could see other luxury brands tightening their belts, delaying new projects, or becoming more conservative with their financial forecasts. However, for Porsche, its immense brand strength and unwavering customer loyalty provide a significant buffer. The brand has faced challenges before, emerging stronger and more focused. The long-term vision remains clear: a future heavily invested in performance-oriented electric vehicles, while continuously refining its iconic ICE offerings. This period might serve as a crucible, forging a leaner, more resilient Porsche that is better equipped to handle the complexities of the modern automotive landscape. Analysts are watching closely, with many predicting a gradual recovery as supply chain challenges ease further and the economies of scale for EV production begin to kick in. The path will undoubtedly be arduous, but the enduring appeal and engineering prowess of Porsche suggest that its brand resilience will ultimately guide it through this turbulent period.

Conclusion

The news that Porsche’s operating profits have plummeted is undeniably jarring, a sharp reminder that even the most prestigious and financially robust brands are not immune to the relentless pressures of the global economy and the seismic shifts within the automotive sector. We’ve seen how a cocktail of persistent supply chain woes, a cautious economic climate affecting even luxury buyers, and the colossal, yet necessary, investments in electrification have converged to squeeze the brand’s once-enviable profit margins. It’s a complex picture, one that reveals the intricate balancing act required to manage a global luxury enterprise in an era of rapid technological change. While the immediate figures are certainly cause for concern, Porsche’s history is replete with examples of overcoming adversity through innovation and strategic adaptability. The road to full recovery won’t be without its bumps, but the strategic shifts currently underway, combined with the enduring strength of the brand and its passionate customer base, offer a glimmer of hope. Only time will tell how swiftly the iconic Zuffenhausen marque can regain its unparalleled stride and continue its legacy of performance and profitability in this ever-evolving world.

Frequently Asked Questions

| What exactly led to Porsche’s operating profits plummeting? | Porsche’s operating profits plummeted due to a combination of factors: persistent global supply chain disruptions (especially for semiconductors), economic headwinds like inflation and rising interest rates impacting consumer confidence even in the luxury segment, and the massive, costly investments required for its ambitious electric vehicle (EV) transition, which currently carry thinner margins. |

| Are there any silver linings or potential benefits for consumers from this situation? | While a profit decline is generally negative for the company, it could lead to increased focus on efficiency, potentially more competitive pricing strategies, or accelerated innovation in future models to regain market share. For some consumers, this might translate into more attractive lease deals or incentives on certain models, especially if inventory begins to build up slightly due to production adjustments. |

| What immediate steps is Porsche taking to address the profit decline? | Porsche is implementing aggressive cost optimization programs across its operations, scrutinizing expenditures, and finding efficiencies in production. They are also strategically prioritizing the production and delivery of their highest-margin models to maximize immediate returns, and working to strengthen and diversify their supply chains. |

| What are the biggest challenges Porsche faces in recovering its profitability? | The biggest challenges include navigating ongoing global economic uncertainties, managing the incredibly high costs of developing and scaling EV production while maintaining brand profitability, and ensuring a stable, efficient supply chain for critical components amidst geopolitical volatilities. Balancing innovation with cost control without compromising brand quality is a tightrope walk. |

| What does the long-term outlook appear to be for Porsche’s financial health? | Despite current challenges, the long-term outlook for Porsche remains cautiously optimistic due to its strong brand equity, loyal customer base, and clear strategic direction towards electrification. As supply chain issues gradually ease and EV production achieves greater economies of scale, profitability is expected to recover. However, the path will require continued strategic agility and disciplined financial management. |

Important Notice

This FAQ section addresses the most common inquiries regarding the topic.