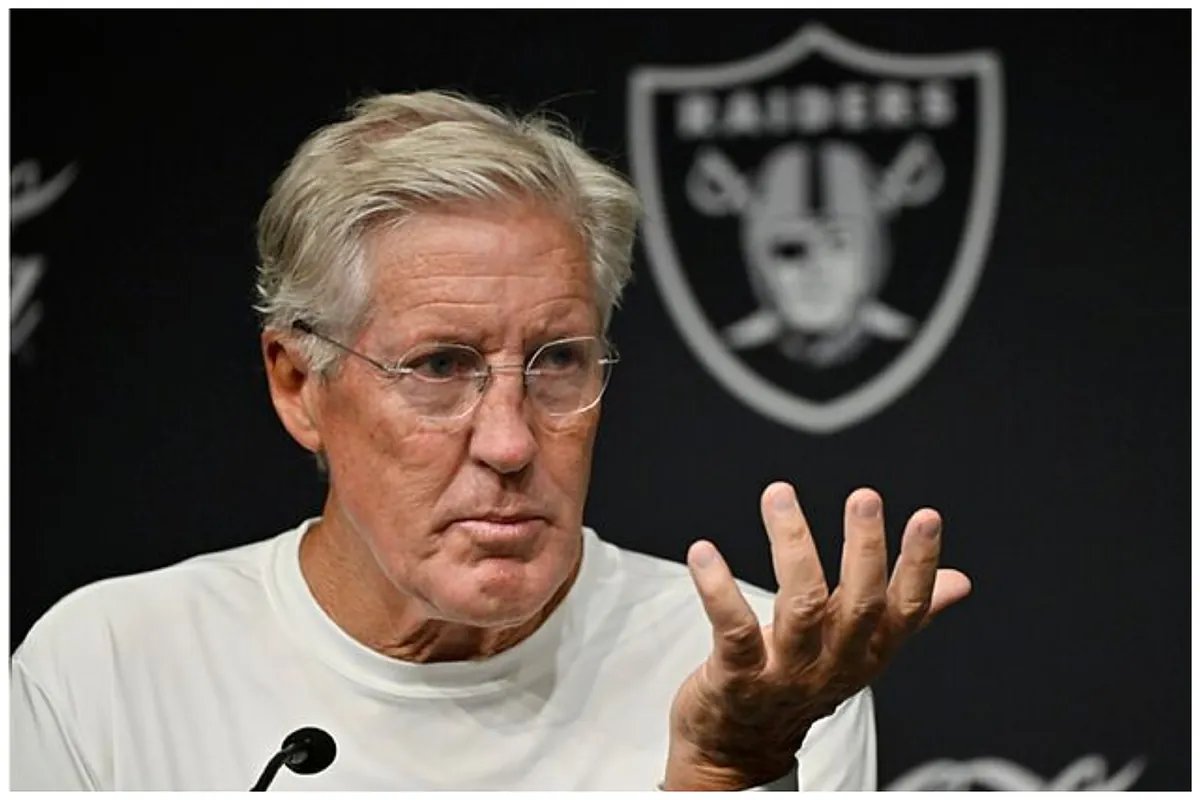

Pete Carroll’s Financial Playbook: Net Worth & Raider Impact

Ever wondered how much a legendary football coach like Pete Carroll is really worth? With a Super Bowl ring, years of dominating college football, and now a new role with the Las Vegas Raiders, it’s a question on a lot of minds. But understanding Pete Carroll’s net worth isn’t just about the numbers; it’s about understanding the value of leadership, strategic brilliance, and the impact one person can have on an entire sport. This article dives deep into his financial playbook, revealing the key factors that have shaped his wealth and what his move to the Raiders could mean for his financial future.

Understanding the Fundamentals of a Coaching Empire

Let’s be honest, figuring out anyone’s net worth is tricky, especially someone as high-profile as Pete Carroll. We’re not just talking about a simple salary; it’s a complex web of contracts, endorsements, investments, and more. So, what exactly goes into calculating a figure like Pete Carroll’s net worth? It starts with his coaching contracts, of course. These contracts, especially at the NFL level, are massive, often including hefty signing bonuses and performance incentives. Think of it like this: the base salary is the foundation, but the bonuses are the extra floors you add to the building.

But it doesn’t stop there. Successful coaches like Carroll often have endorsement deals with major brands. These deals can range from appearing in commercials to promoting products on social media. Then there are investments – stocks, real estate, and other ventures that can significantly boost their overall wealth. And let’s not forget about potential revenue from books, speaking engagements, and other media appearances. All of these elements combine to create a financial picture that’s far more complex than just a simple salary figure. It’s kind of like trying to understand a complex play in football – you need to see all the moving parts to grasp the whole picture.

Why does this matter today? Well, for one, it’s fascinating to see how success in sports translates into financial prosperity. But more importantly, understanding the financial landscape of a figure like Pete Carroll gives us insight into the business side of professional sports. It highlights the value placed on leadership, strategic thinking, and the ability to build a winning team. These are qualities that are not only valuable on the football field but also in the business world. Plus, it’s just plain interesting to see how the best in the game are rewarded for their achievements.

Key Benefits and Advantages of a Winning Legacy

Okay, so we know Pete Carroll has amassed a significant fortune, but what are the real-world advantages of having that kind of financial security? The most obvious benefit is, well, financial freedom. It allows Carroll to pursue his passions without worrying about the next paycheck. It gives him the ability to invest in causes he believes in, support his family, and live a comfortable lifestyle. Beyond that, a strong financial foundation can provide a sense of stability and security, allowing him to take risks and pursue new opportunities without fear of failure. It’s like having a solid offensive line – it gives you the confidence to make bold moves and take chances.

In Carroll’s case, his wealth has likely enabled him to create a lasting legacy. He has the resources to establish foundations, support charitable organizations, and invest in the development of young athletes. He can also use his platform to advocate for causes he believes in and make a positive impact on the world. From my experience, having that kind of influence is something that money can’t directly buy, but it certainly helps to amplify your voice. It seems that Carroll’s financial success has given him the opportunity to not only achieve personal fulfillment but also to make a meaningful contribution to society.

Think about it: Carroll’s coaching success at USC led to increased revenue for the university, boosting the athletic program’s budget and attracting top talent. His Super Bowl win with the Seahawks not only brought glory to the city of Seattle but also increased the team’s value and generated millions in revenue. These are just a couple of examples of how his success on the field has translated into tangible economic benefits for the organizations he’s been a part of. It’s a testament to the power of leadership and the impact one person can have on an entire community.

Implementation Strategies: Building a Financial Fortress

So, how does someone like Pete Carroll build such a substantial net worth? It’s not just about earning a high salary; it’s about smart financial planning, strategic investments, and a long-term vision. Here’s a look at some of the key strategies that likely play a role in managing his wealth:

Step-by-Step Approach

- Diversification: Don’t put all your eggs in one basket. Spreading investments across different asset classes, like stocks, bonds, and real estate, can help mitigate risk and maximize returns. It’s like having a balanced offensive attack – you don’t want to rely solely on the run or the pass.

- Long-Term Investing: Building wealth takes time. Focus on long-term investments that have the potential to grow over many years. Think of it as building a championship team – it requires patience, discipline, and a commitment to the long-term vision.

- Tax Planning: Minimize your tax burden through strategic tax planning. This can involve utilizing tax-advantaged accounts, making charitable donations, and taking advantage of other tax breaks. Honestly, this is where having a good financial advisor is crucial.

- Real Estate Investments: Many high-profile individuals invest in real estate, which can provide both income and appreciation over time. It’s a tangible asset that can offer stability and security.

- Endorsement Deals: Leverage your brand to secure endorsement deals with reputable companies. These deals can provide a significant source of income and enhance your overall financial profile.

Best Practices

- Seek Professional Advice: Don’t go it alone. Work with a team of experienced financial advisors, accountants, and lawyers to manage your wealth effectively.

- Create a Budget: Track your income and expenses to ensure you’re living within your means and saving enough for the future.

- Review Your Portfolio Regularly: Monitor your investments and make adjustments as needed to ensure they align with your financial goals.

- Stay Informed: Keep up-to-date on the latest financial news and trends to make informed decisions about your money.

- Protect Your Assets: Obtain adequate insurance coverage to protect your assets from unforeseen events.

These strategies aren’t just for millionaires, either. The principles of diversification, long-term investing, and smart tax planning can be applied at any income level. It’s all about taking control of your finances and making informed decisions that will help you achieve your financial goals. Just like Carroll develops a game plan for each opponent, you need to develop a financial plan for your future.

And speaking of smart decisions, it’s always good to stay informed about the market. For example, checking out articles like Toyota’s New V8: More Than Just Supercar Dreams can give you insights into potential investment opportunities and overall economic trends.

Common Challenges and Solutions in the Financial Game

Even with the best strategies in place, building and maintaining wealth isn’t always easy. There are challenges and obstacles that can arise along the way. Here are some common hurdles and practical solutions:

- Market Volatility: The stock market can be unpredictable, and investments can fluctuate in value. To mitigate this risk, diversify your portfolio and focus on long-term investing. Don’t panic sell during market downturns; instead, consider it an opportunity to buy low.

- Taxes: Taxes can eat into your investment returns. Work with a tax advisor to minimize your tax burden through strategic tax planning.

- Inflation: Inflation erodes the purchasing power of your money. Invest in assets that have the potential to outpace inflation, such as stocks and real estate.

- Unexpected Expenses: Life is full of surprises, and unexpected expenses can derail your financial plans. Build an emergency fund to cover these costs without having to dip into your investments.

- Poor Investment Decisions: Making bad investment decisions can cost you dearly. Do your research before investing in anything and seek advice from a qualified financial advisor.

It’s important to remember that everyone makes mistakes, even the wealthiest individuals. The key is to learn from those mistakes and adjust your strategy accordingly. It’s kind of like a football team adjusting its game plan after a tough loss – you analyze what went wrong, make the necessary changes, and come back stronger.

Real-Life Applications and Examples: Carroll’s Coaching Tree

Let’s take a closer look at how Pete Carroll’s financial acumen might play out in real-life scenarios. Imagine he wants to invest in a new business venture. He wouldn’t just throw money at it blindly. Instead, he would likely conduct thorough research, analyze the potential risks and rewards, and seek advice from experts. He might also leverage his network to find strategic partners and gain access to valuable resources. It’s the same approach he takes on the football field – he’s always prepared, always strategic, and always looking for an edge.

Consider his move to the Raiders. While the exact details of his contract haven’t been publicly disclosed, it’s safe to assume that it includes a significant salary and potential performance bonuses. This move not only provides him with a new challenge and opportunity but also strengthens his financial position. It’s a win-win situation. And you know, it’s interesting to see how coaches move around in the NFL. It almost makes you wonder if the team culture is as important as people make it out to be these days. For instance, it’s kind of funny how some fans reacted to Myles Garrett dismissing Eagles trade rumors – it just goes to show how much people care about their teams!

Here’s another example: Let’s say Carroll wants to give back to the community. He could establish a foundation to support youth sports programs or provide scholarships to deserving students. He could also use his platform to raise awareness for important causes and encourage others to get involved. This type of philanthropic activity not only benefits the community but also enhances his reputation and strengthens his brand. It’s a powerful way to use his wealth to make a positive impact on the world.

Future Outlook and Trends: What’s Next for Carroll’s Empire?

So, what does the future hold for Pete Carroll’s financial empire? Well, that’s hard to say for sure. But here are a few trends and opportunities that could shape his financial future:

- Continued Success with the Raiders: If Carroll can lead the Raiders to success, it will undoubtedly boost his brand and increase his earning potential.

- Increased Endorsement Opportunities: A successful stint with the Raiders could lead to new endorsement deals and other commercial opportunities.

- Media Opportunities: Carroll could pursue opportunities in broadcasting, writing, or other media ventures.

- Investments in Emerging Technologies: Carroll could invest in companies that are developing innovative technologies in areas like sports analytics, healthcare, or renewable energy.

- Philanthropic Activities: Carroll could increase his philanthropic activities and establish a lasting legacy through charitable giving.

The world of professional sports is constantly evolving, and new opportunities are always emerging. The truth is, Carroll’s ability to adapt and innovate will be key to his continued success, both on and off the field. He has already proven his ability to build winning teams and create a lasting impact. It feels like his financial future is bright.

And honestly, the future of sports itself is fascinating. It’s amazing how technology is changing everything, from training methods to fan engagement. If you’re like most people, you’ve probably heard about the rise of eSports and the increasing popularity of games like Apex Legends. Speaking of which, it’s worth checking out how Shroud backs ARC Raiders for GOTY – it just goes to show how much the gaming world is influencing mainstream culture.

Conclusion: Key Takeaways and Next Steps in Understanding Pete Carroll’s Net Worth

Alright, so we’ve covered a lot of ground here. Let’s recap the key takeaways regarding Pete Carroll’s net worth:

- Pete Carroll’s net worth is estimated to be in the multi-million dollar range, reflecting his successful coaching career and savvy financial management.

- His wealth is derived from a combination of coaching salaries, endorsement deals, investments, and other income streams.

- He likely employs a variety of strategies to manage his wealth, including diversification, long-term investing, and tax planning.

- His financial success has enabled him to pursue his passions, support his family, and make a positive impact on the world.

- His future financial outlook is bright, with potential opportunities for continued growth and success.

So, what are the next steps you can take to learn more about managing your own finances? Start by educating yourself about the basics of personal finance. Read books, articles, and blogs on topics like budgeting, saving, investing, and debt management. Seek advice from qualified financial professionals. And most importantly, take action. Start implementing the strategies you’ve learned and track your progress along the way. Building wealth takes time and effort, but it’s an achievable goal for anyone who is willing to put in the work.

What do you think? Does Pete Carroll’s financial success inspire you to take control of your own finances? What are some of the biggest financial challenges you’re facing right now? Let’s discuss in the comments below!